What's wrong with Intel?

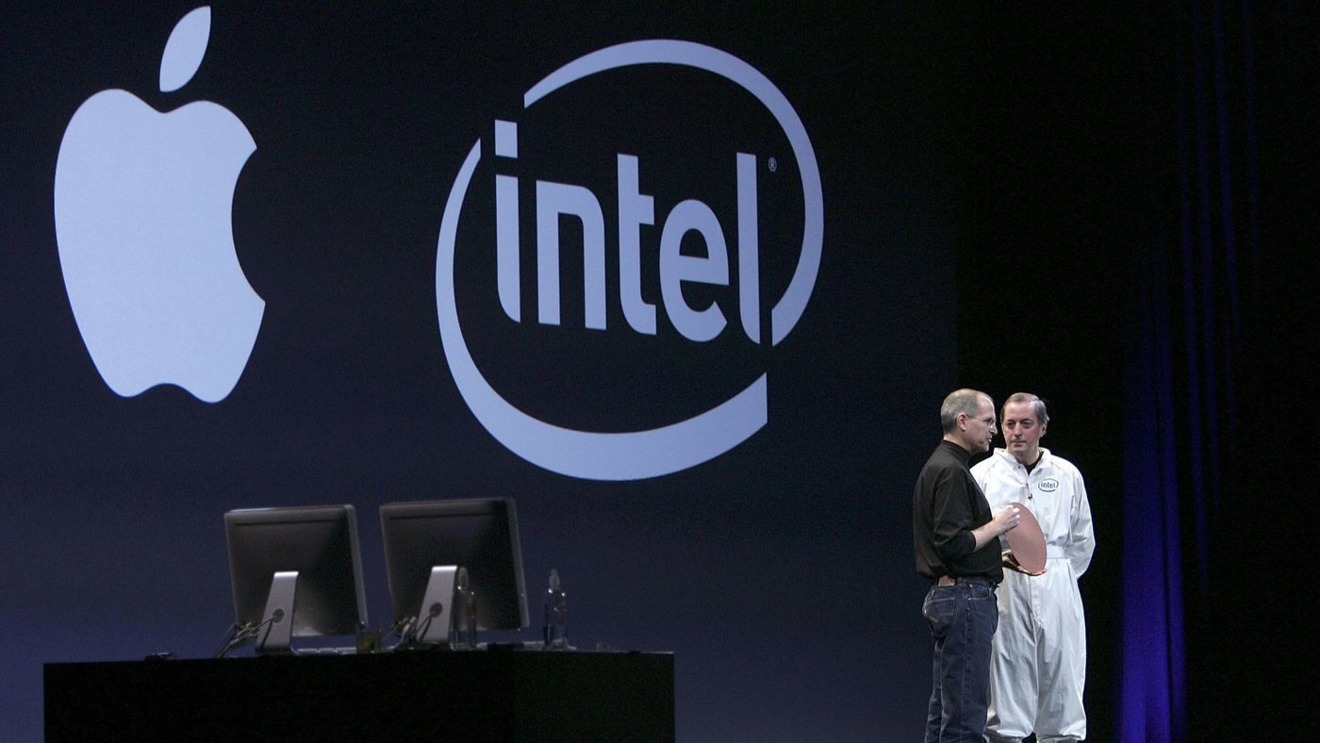

Apple famously adopted Intel's processors for Macs in a 2005 announcement

by Steve Jobs, which outlined that new iMacs and notebooks

would begin

shipping with Intel's freshly released x86 Core processors starting in early 2006.

WWDC05 helped to prepare developers to make the switch to ensure that buyers

of new Intel Macs could continue to use their Mac software.

That move to Intel benefitted Apple and its Mac users in a variety of ways.

New Intel Macs could leverage the economies of scale in x86 chips to

deliver regular new improvements in processing power at affordable

prices that were not being delivered by Apple's existing PowerPC chip providers.

It also meant that new x86 Macs were hardware-compatible with running

Microsoft Windows and the software designed for it. Beyond booting Windows,

Intel Macs could also host Windows apps natively on the

Mac desktop or virtualize entire Windows sessions.

Additionally, video games written for x86 PCs could be

more easily ported to

run as Mac apps.

So what's changed over the last 15 years that would make

Apple interested in now moving away from Intel's x86 chips?

There are a number of important factors. One is that

Microsoft Windows and its Windows software have dramatically faded in importance

as mainstream consumer spending and technical investments have shifted

from PCs to mobile devices.

Windows and x86 compatibility are still important to some users,

but neither has been less important to the majority of users than they are today.

Additionally, most users who have some specific need to use x86 software ar

often the least likely to even consider a Mac from all of the various other PC options available.

Conversely, most Mac users have no need to host x86 or Windows code.

According to historical service data records collated by AppleInsider spanning

the last decade, while around 15% of Mac users had Boot Camp installed in 2010, only about 2% of machines

today are typically set up to dual boot into Windows.

One specific area that was expected to make a big difference for Intel

Macs was video gaming. Yet PC gaming is still solidly planted on

Windows PCs and Macs haven't materially shifted simply because of an influx of

ported Windows titles.

On the flip side, Apple has also created something that has never existed before: its own mobile platform larger than Windows and unrelated to x86. Across the last decade,

rather than investing solely in Intel's x86-related platforms,

Apple has been increasingly investing in its independent tools and infrastructure.

This includes Apple's custom ARM silicon as well as its LLVM

software compiler, Swift language, Xcode development tools,

App Store platform, new services such as Apple Arcade, and all of the related

work that has established iOS and its analogs as the leading platform for premium smartphones used by

affluent customers; in tablets adopted by enterprise users; and in new

computing areas including wearables such as Apple Watch and AirPods.

Intel's first no from Apple

The last time Apple was faced with the option to use Intel chips in

its Mac computers, none of this existed.

Back in the early 1990s, Apple had internally studied the idea of moving

the Mac from its initial Motorola 68K processors to Intel x86 chips under the Star Trek project but effectively decided that it would be too difficult to move the Mac's existing library of third party 68k software to Intel x86 chips, with little to gain from the move.

Instead, Apple pursued a new partnership with IBM and Motorola to develop

an entirely new chip platform for desktop PCs based on IBM's POWER architecture.

The resulting PowerPC was a new,

fresh design unladen with the decade-long baggage of Intel's x86's 1980s legacy.

Fresh PowerPC chips initially helped Apple's PowerMacs to remain competitive

with Intel-based Windows PCs, while Apple supported emulation of older

software on much faster new PowerPC chips.

However, PowerPC's newness also kept many of the project's other initial

partners from fully adopting it the way Apple had. By the early 2000s, Apple was the only PowerPC user building

PCs in any quantity.

But Apple also didn't own or control the direction of PowerPC development.

IBM and Motorola's Freescale were largely distracted by designing and

building embedded PowerPC chips destined for automotive or video

game consoles rather than being focused on serving the needs of Apple's Macs.

The circumstances that justified Apple saying "no" to Intel around

1993 changed enough that by 2005 Apple was ready to say "yes" to shifting its Mac platform to Intel's x86. Yet while celebrating that decision in public, Apple was also internally

making other plans that wouldn't involve Intel.

A no from Intel, then a no back from Apple

The first was the iPhone, which Apple initially wanted to power with an

Intel-built XScale chip. Intel's chief executive at the time, Paul Otellini,

initially said no to Apple, fearing that its phone

project wouldn't be successful enough to justify Intel's investment.

That turned out to be wildly mistaken. Within just a couple of years,

Apple's success with the iPhone was so obvious that Intel itself desperately wanted to work with Apple on future mobile products, particularly its upcoming tablet. Intel expected

Apple to select its upcoming x86 Silverthorne mobile chip, later renamed as Atom.

But this time Apple said "no" to Intel, and instead initiated

the development of a project to build a new customized ARM "

System on a Chip" that could power both its upcoming iPad and subsequently iPhone 4. The project was delivered in 2010 as A4.

Apple A4

Another Apple no to Intel's x86

Apple's "no" also included using the A4 in another product already

using an Intel x86 chip: Apple TV. The initial versions of Apple TV

had effectively been a scaled-down x86 Mac, but in 2010

the product became another iOS-based device running Apple's ARM SoC.

Unlike Macs, Apple TV didn't gain any benefits at all from using x86 chips.

There was no way to run Windows software on it, and it didn't need Intel's

leading performance. Conversely, the switch to using Apple's A4 enabled

Apple to sell its TV device for much less; the price dropped from $229 to $99.

The shift from Intel wasn't the entire reason for that price drop, but Apple's

silicon helped it to deliver a cheaper product offering that could appeal to broader audiences.

Across the next decade, Apple aggressively invested in its own

A-series silicon development, in parallel but independent from its ongoing

use of Intel chips in Macs. Apple's competitive investment in its own mobile chips was so effective that

it relegated Intel into a minority player in mobile chips. Atom ended up being canceled before the decade even ended.

From winter to Android and iOS on ARM

Apple's continued investment in its custom silicon didn't just block Intel from

establishing any real market power in the mobile space. It also helped to establish

Apple's software platforms as essential.

While most of the tech media was predicting that Android would become

the "new Windows" with Microsoft-like control over the consumer

tech industry, what actually happened was that Apple became both the Intel and the Windows of mobile devices.

Rather than becoming the new Windows, Android ended up playing the role of pirated copies of Windows: a competitive placeholder that effectively prevented any other real competition from gaining traction— including, ironically, Microsoft's own efforts to enter mobile.

Google was doing all of the hard and frustrating work of maintaining a broadly licensed platform across various commodity hardware makers for nearly nothing, while Apple was earning virtually all of the available profits on iOS.

And while both Android and iOS were investing in ARM,

only Apple was investing in custom development of its own optimized chips

. The mobile platforms Apple developed over the last decade generated

hundreds of billions in hardware sales and additional scores of billions

in App Store and subscription revenues, far more than Google's Android.

They're so valuable, in fact, that Google pays Apple additional billions to access its user base to offer search and advertising on iOS.

The size and importance of Apple's mobile platforms are so large that they now greatly overshadow the PC business itself. Apple earns far more money from its mobile platforms than from the Mac. Apple's mobile platforms can now contribute more to the Mac than the WinTel platforms can.

That's in evidence from Apple's recent strategies

of using Project Catalyst to move existing iPad

software to the Mac. There is far more potential

in moving modern iPad code to the

Mac than there is in supporting legacy x86 Windows software on Intel Macs.

It's also notable in Apple having created ARM SoCs

that rival Intel's x86 notebook chips in performance, despite being developed for lower-powered mobile devices.

Apple has the ability to develop new custom chips optimized for

a Mac, potentially using multiple chips in the device.

This would also make it that much easier for iPad

and iOS developers to move their existing code to

the Mac, even if it makes it harder to move legacy x86 code to new Macs.

One of the largest problems associated with moving an existing

platform to a new processor architecture is how to migrate

the existing library of software. Once again,

Apple now has a new solution available that hasn't been available before.

Developers who sell their software through

the App Store can upload code that can be compiled for different platforms and delivered automatically in the correct form to buyers. This doesn't solve every issue

but does make it easier than ever to migrate to new hardware.

Apple itself relied on this mechanism to help roll

out a new 64-bit iOS platform after the release of A7. On the Mac,

a similar migration to a new hardware architecture

could similarly drive adoption of the Mac App

Store and ARM Macs in tandem.

Beyond ARM

Apple's successes in mobile silicon are not just due to ARM cores, however. Both Google and Microsoft have worked to develop ARM-based phones, tablets, and even more conventional notebook-like devices without similar success.

All of the Android commodity hardware makers, including Samsung and Huawei, also use ARM chips without generating anywhere near the level of commercial success that iPhones and iPads have for Apple.

Apple's incredible scale in shipping a broad number of ARM-based devices in vast volumes, consistently over the last decade, has made it very hard to compete against. However, Apple's success in custom silicon isn't just a matter of having invested in ARM rather than buying chips from Intel.

A larger element of Apple's custom silicon is the vertical integration it allows, including optimizations in silicon that can be custom-built to serve needs in the operating system and offer unique capabilities that enable differentiating features. The existence of ARM facilitates this, but the value of Apple's custom silicon efforts grow beyond simply its use of ARM-compatible CPU cores.

In fact, the ARM cores Apple uses make up a minority of the

real estate on its custom SoCs. A larger part is devoted to GPU

cores, which are not ARM. Apple initially licensed GPU

core designs from Imagination Technologies, but has since

moved to develop its own custom GPU cores.

Apple has also developed its own audio processing, encryption,

video codec, storage controller, artificial intelligence, and other

unique logic cores that are all vertically integrated and also mass-

produced in the same component, creating massive savings via economies of scale.

Apple is also regularly reusing and adapting the custom

silicon it has developed, enabling it to enter other markets at a lower cost than a competitor lacking such a library of previous work to draw from. For example, Apple has used

cores developed for iPhones and iPads to drive its wearables

and power devices such as HomePod.

Apple

TV has also regularly made use of previous generations of A-chips.

Apple is also already using much of the logic of its A-series chips,

minus the primary ARM CPU cores, to perform supporting tasks on its recent Macs.

Apple refers to the most recent version of its custom chips used in

Macs as the T2, which supports Touch ID, hardware-accelerated encryption and media codecs, support for Touch Bar and Hey Siri, and a variety of other functions. Some of

these

features are also powered by ARM cores or microcontrollers, while others use different core technologies.

However, the value here isn't just from using "ARM," but rather from the deep integration and optimizations Apple can make in designing and using its own chip designs. These investments are extremely expensive but can support solid, differentiating features that are hard to compete against.

-xl.jpg)

Google demonstrated this in creating its own Visual Core silicon to enhance photography on its Pixel phones. That was a very expensive endeavor but failed to achieve much because it didn't result in significant hardware sales.

In fact, the most successful Pixel phone by far has been the company's cheapest Pixel 3a, which doesn't even use the company's custom imaging core at all. In fact, it achieves its affordable price by not using custom silicon. Apple has made custom silicon look easy, but it's anything but.

Microsoft also made some waves in announcing that its Surface notebook was using a "custom ARM processor" built by Qualcomm, but that was largely marketing hot air because there wasn't really anything noteworthy about the chip it used apart from running at slightly higher clock speed.

The vast gulf between talking about or trying custom silicon and the work Apple had delivered offers some perspective on what Apple can accomplish going forward. That will include in its existing mobile devices, its emerging wearables portfolio, any new Macs that are powered by advanced custom silicon, as well as-yet-unreleased devices that serve entirely new roles ranging from health to home integration and other promising categories.

One notable example is the rumored Apple Glasses, which would need advanced silicon processing to handle imaging, motion, graphics, security, native intelligence, power management, and wireless connectivity in an extremely compact package.

ARM is developing elements of that package, but Apple has been working on all of those features in its existing custom silicon already, financing the extreme cost of that work with its unique volumes of mobile device sales.

0 Comments